Defining a Payback Period

Skylar Scott, Researcher

January 22, 2020

When the term “payback period” is heard, the mind can easily wander back to finance class. A payback period is the time it takes for an investment to achieve break-even point, or the point in which your initial outlay is paid back. Traditionally, payback periods are used to compare two potential investments as a tool to decide which takes on less risk. Simply put, the investment with a shorter payback period is more attractive (Laws, 2018).

In economics, payback periods are used when discussing opportunity cost, or the cost incurred by not choosing the next best alternative. By calculating a payback period the benefits of each choice can be put in quantitative terms so a positive economic choice can be made.

Recently, I was asked to devise methodology to measure the marginal benefit to the state accrued from the completion of a certificate from a technical college (https://udrc.utah.gov/utechroi/index.html). As part of my research, I saw several different methods commonly used for calculating return including simple wage growth, and lifetime income tax collected. These methods are used as they can easily quantify the success of a program, but do not directly measure how long it takes for a state to realize a break-even point. For this a payback period is necessary.

The approach for using a payback period for a technical college is very different than choosing a potential investment in the private sector. Unlike private investments, technical college has no direct alternative and its benefit isn’t just monetary, as individuals can uplift the community in a variety of ways (Kotamraju, 2016). The advantage to using a payback period is it provides the state with an estimate on when appropriated funds can be recouped with tax dollars. It can also be used as a tool for monitoring the progress of programs as graduates or funding change over time.

The cohorts available for this study included classes from 2011 – 2017 and only included students who achieved a certificate at UTech institution. The methodology I choose was a simple a payback period that can easily be duplicated as additional cohorts become available.

PBP = Initial Cash Outlay / ∑(P1, P2, Pn) ≥ 1

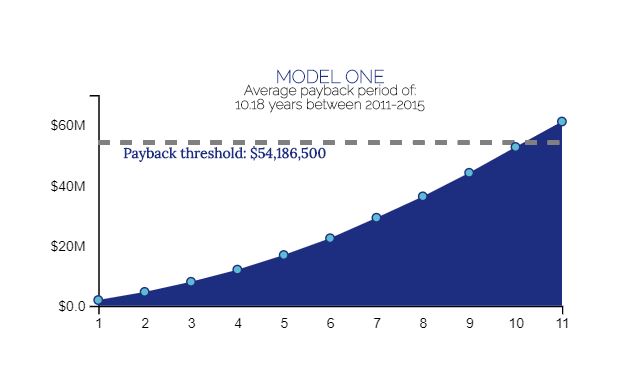

In the case of state funded public programs, the initial cash outlay is the funds appropriated by the state in a given budget year. Inflation adjusted wages are then taken from the individual prior to entering a program, and subtracted from total wages earned after certification (represented by P). Finally each period is summed and divided by the initial cash outlay until the quotient is equal to one. Using this method, the average payback period across all studied cohorts was 10.18 years with a standard deviation on .34 years.

Although the payback period in my study remained fairly constant, as additional years of data are obtained the payback period model can be used to monitor the progress of Technical Colleges in the state.

REFERENCES

Laws, J. (2018). Investment appraisal. In Essentials of Financial Management (pp. 87-106). Liverpool: Liverpool University Press.

Kotamraju P. Measuring the Return on Investment for CTE. Techniques: Connecting Education and Careers. 2011;86(6):28-31. Accessed January 13, 2019